The Next Phase in Space Connectivity: Blue Origin’s TeraWave Meets Starlink’s Evolving Ambition

Blue Origin just filed plans for a 5,408-satellite constellation. Not a consumer broadband play. Not a Starlink clone. Something different: an enterprise-grade, multi-orbit data backbone designed to move up to six terabits per second across the planet. They’re calling it TeraWave, and it tells us something important about where orbital infrastructure is heading—and what it will cost the environment above our heads to get there.

What TeraWave Actually Is

TeraWave is not about giving your neighbour faster Netflix. It is conceived as a high-capacity global data network for data centres, governments, and large corporate users that need symmetrical throughput and resilient global routing. The architecture has two layers: 5,280 satellites in low Earth orbit using Q/V-band radio-frequency links, projected to deliver speeds of up to around 144 Gbps to enterprise terminals, and 128 satellites in medium Earth orbit linked by optical communications, capable of aggregated throughput up to 6 Tbps.

That multi-orbit, mixed-link approach is deliberately different from the typical playbook for broadband constellations. Blue Origin’s FCC filing makes this explicit. The network is designed to support fixed high-speed links between major network hubs and serve a limited number of high-demand customers—tens of thousands, not tens of millions. Deployment is scheduled to begin in late 2027, using Blue Origin’s New Glenn rocket, whose seven-metre fairing can house larger satellite batches than most current vehicles.

The timing is no accident. Former ULA chief executive Tory Bruno was appointed to lead Blue Origin’s national security unit in December 2025, signalling an intent to directly challenge SpaceX’s Starshield and government-grade secure communications offerings.

Starlink’s Current Scale and Technology Path

SpaceX’s Starlink is already the dominant satellite internet network by user base and deployed infrastructure. As of late 2025, it has surpassed nine million subscribers across more than 150 markets and maintains a constellation of over 9,000 active satellites in LEO, typically orbiting below 550 kilometres.

The system continues to evolve. The forthcoming V3 generation of Starlink satellites is expected to significantly increase per-satellite capacity compared with the existing V2 Mini spacecraft. Industry analysis and regulatory filings indicate that each V3 satellite could handle around one terabit per second of downlink capacity, a step-change that, combined with mass deployment aboard Starship, could add enormous network capacity in a single mission. SpaceX has also announced plans to lower some Starlink satellites from around 550 kilometres to 480 kilometres, a move intended to improve both performance and space safety.

The point is this: Starlink is not standing still. It is not a fixed target for competitors to aim at. It is a moving, expanding, deepening presence in orbit.

Different Animals, Same Jungle

The design philosophies of TeraWave and Starlink reflect genuinely distinct market corners within the broader satellite ecosystem.

Starlink is engineered for breadth. It serves consumers, businesses, governments, emergency responders, and remote communities. Its vast satellite count and global coverage aim to blanket the planet with broadband connectivity. Its optical crosslinks, inter-satellite laser links, are already operational in the constellation, routing traffic across the network without relying solely on ground stations.

TeraWave is engineered for depth. With optical inter-satellite links and a multi-orbital architecture, it targets a far smaller user base that demands very high throughput and network resilience rather than mass consumer access. Blue Origin’s explicit use of laser-based optical links between satellites and to gateways is central to reaching terabit-scale aggregate throughput, though such links remain technically demanding, particularly given atmospheric interference at the ground segment.

The distinction matters. These are not head-to-head competitors in any simple sense. They are different species occupying adjacent niches in an ecosystem that is filling up fast.

The Congestion Problem Nobody Wants to Talk About

Here we arrive at the part that matters most, at least for anyone who thinks about orbit as a shared resource rather than a private highway.

It is tempting to talk about orbital congestion as a single number: how many objects are up there. But congestion is a relationship. It is defined by how many operational spacecraft share similar altitude shells, inclinations, and crossing geometries, as well as spectrum and ground infrastructure choke points. A constellation at 1,100 kilometres and one at 500 kilometres may never physically interact. Two at 530 kilometres, with overlapping inclination bands, will interact constantly.

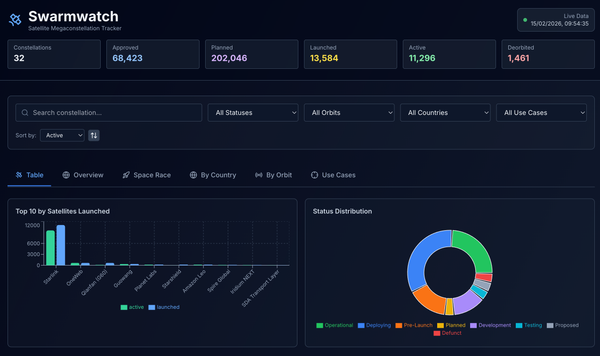

Still, a simple order-of-magnitude snapshot helps set the scene for what the mid-2030s could look like.

Using only announced or authorised constellation sizes from primary or high-quality sources:

- Starlink Gen2 authorised: circa 15,000

- TeraWave: 5,408

- Amazon Leo: 3,236

- Guowang (China): 12,992

- IRIS² (EU): 290

- OneWeb (Expansion): 440

That subset alone sums to roughly 37,366 satellites on the books. And it does not include China’s Qianfan constellation, GalaxySpace, Honghu-3, or several other filled but earlier-stage programmes that could collectively add thousands more.

If these systems are built out to their stated maxima on broadly plausible schedules: Amazon Leo by 2029, IRIS² by 2030, Starlink’s newly authorised tranche by 2031, TeraWave beginning deployment in 2027, Guowang hitting ITU milestone obligations through the early 2030s, then the mid-2030s orbital environment is defined by three practical consequences.

First, conjunction rates will rise non-linearly. The probability of close approaches does not scale linearly with the number of satellites. It scales with the square of the number of objects sharing similar orbital regimes. When you double the population in a given altitude band, you roughly quadruple the number of potential conjunctions. Current space surveillance networks already struggle to track the load from around 11,000 active satellites and over a million pieces of debris larger than a centimetre. Adding another 25,000 or more operational spacecraft—each manoeuvring, station-keeping, and eventually deorbiting—will transform collision avoidance from an occasional operational task into a continuous, computationally intensive, multi-operator coordination problem.

Second, spectrum and interference management will become a bottleneck. Satellites do not just occupy physical space; they occupy electromagnetic spectrum. As constellations proliferate in overlapping frequency bands—particularly Ku, Ka, Q, and V—the coordination burden on operators and regulators grows. The International Telecommunication Union’s filing system was designed for an era of dozens of geostationary satellites, not tens of thousands of LEO and MEO spacecraft competing for the same bandwidth. TeraWave’s use of Q/V-band, for instance, places it in frequency neighbourhoods already claimed or sought by other operators. Managing interference across this many systems will require coordination frameworks that do not yet exist at the necessary scale or speed.

Third, the debris environment becomes a governance question, not just an engineering one. Every constellation operator publishes deorbit plans and end-of-life compliance rates. SpaceX has been broadly responsible in this regard; others have yet to prove their track records at scale. But even with 95 per cent successful deorbit rates—a figure that would be historically excellent—a constellation of 13,000 satellites leaves 650 uncontrolled objects. Multiply that across half a dozen mega-constellations and the residual debris population from nominally successful programmes becomes a significant orbital hazard in its own right. The Kessler syndrome—a cascade of collisions generating debris that triggers further collisions—does not require catastrophic failure. It only requires enough objects in similar orbits to exceed the environment’s capacity for natural decay.

Amazon Leo and the Wider Field

Neither Starlink nor TeraWave operates in isolation. Amazon Leo (formerly Project Kuiper) continues to progress as a consumer broadband competitor, with plans for 3,236 LEO satellites and a directive to launch roughly half that number by mid-2026. Its relationship with TeraWave is worth watching. Both companies trace back to Jeff Bezos, but they are structurally separate entities targeting different segments. Tim Farrar of TMF Associates has speculated that TeraWave could represent an effort to pressure Amazon’s leadership to keep investing in space, or even to spin Leo off to Blue Origin—a corporate chess move with orbital implications.

Meanwhile, China’s Guowang constellation is the programme that should command more attention than it typically receives in Western media. With 12,992 satellites filed with the ITU and a near-term target of 400 in orbit by 2027, Guowang is explicitly state-led, dual-use, and integrated into Beijing’s long-term digital sovereignty strategy. It must deploy 10 per cent of its constellation by September 2029 and 50 per cent by 2032 to comply with ITU licensing rules. The deployment cadence required to meet those milestones will itself become a significant factor in LEO traffic management.

Europe’s IRIS² is smaller and later, but strategically important as the EU’s first sovereign multi-orbit connectivity constellation. And OneWeb, now part of Eutelsat, continues to evolve as a quasi-national asset serving both commercial and government customers.

The result is not a market with one dominant player and a handful of challengers. It is a multi-polar orbital environment in which American, Chinese, and European operators are simultaneously building out infrastructure across overlapping altitude bands, each with different governance frameworks, different debris mitigation standards, and different strategic imperatives.

What This Actually Means

The satellite connectivity landscape is diversifying in genuinely new ways. Starlink pioneered global broadband at scale and continues to push its capacity envelope with each generation. TeraWave introduces a different proposition: ultra-high-throughput backbone networking for organisations whose data demands exceed anything consumer broadband was designed for. Amazon Leo, Guowang, IRIS², and others fill in the spaces between and beyond.

But diversification without coordination is just congestion by another name. The mid-2030s orbital environment, with potentially 40,000 or more active satellites sharing LEO and MEO, will test every assumption we currently hold about space traffic management, spectrum governance, and debris sustainability.

We are building the architecture of global connectivity above our heads. The commercial case for each of these constellations may be sound in isolation. The collective case for how they coexist in a finite orbital environment has barely been made at all.

That is the conversation we need to be having. Not whether TeraWave can compete with Starlink, it is not really trying to, but whether the orbital commons can sustain the ambitions of everyone who wants to build in it.

This article reflects the views of the author alone and is written in a personal capacity. It does not represent the views of any employer, institution, or affiliated organisation.

References: